The Houthis’ Approach to Paying Public Sector Salaries: Objectives and Potential Risk

| Getting your Trinity Audio player ready... |

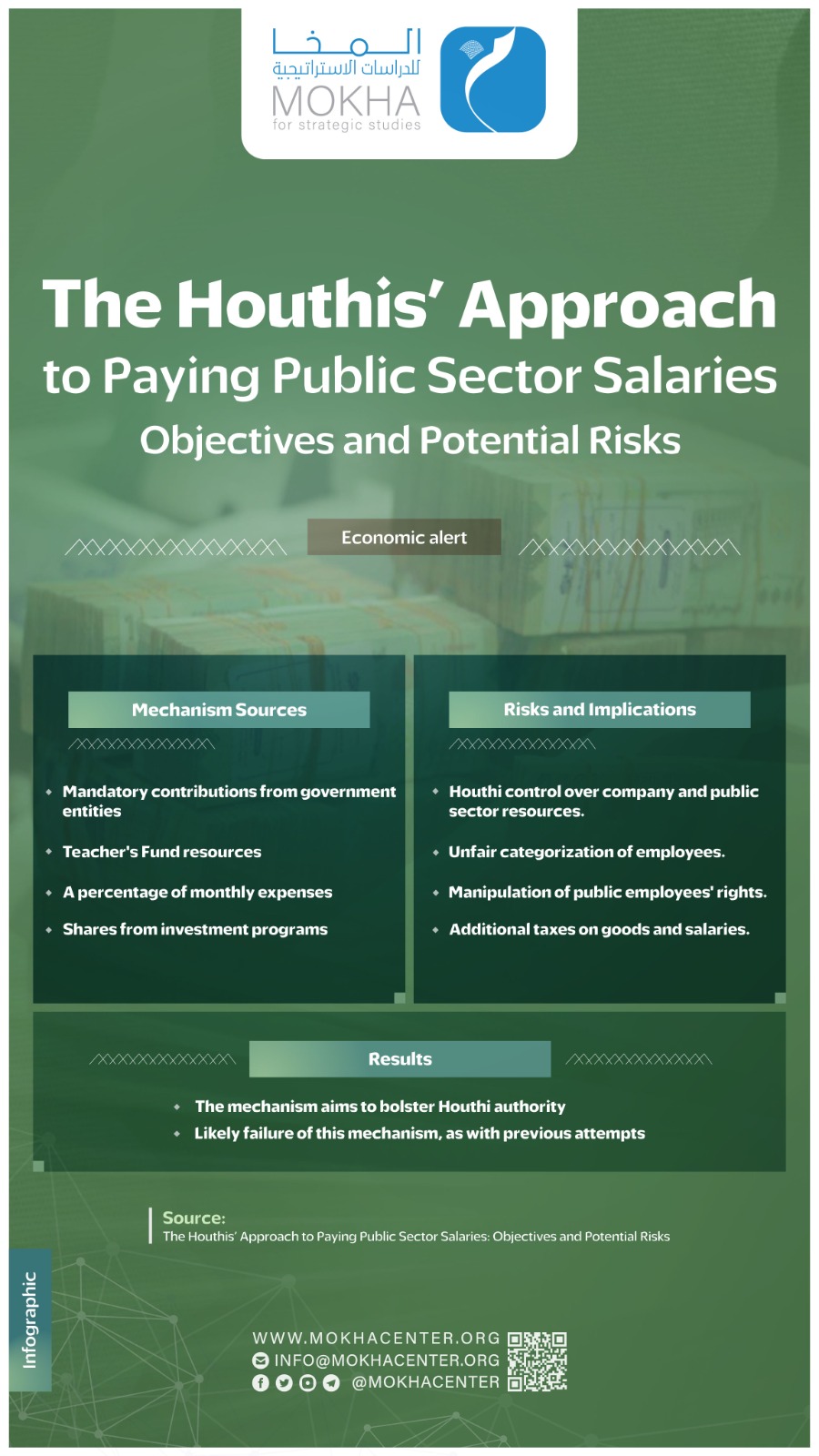

In December 2024, the Houthis introduced what they termed the “Law on the Temporary Exceptional Mechanism to Support the Salary Bill of State Employees and Address the Issue of Small Depositors”. According to their claims, this law aims to tackle the issue of disrupted salaries for public employees and ensure equitable distribution of monthly income among public service sector workers.

The Concept and Objectives of the Mechanism

The mechanism is designed around establishing a dedicated account at the Central Bank branch in Sana’a, controlled by the Houthis. This account serves as a repository for financial revenues managed by the Ministry of Finance, under Houthi authority. Revenues are deposited from the general government account after covering mandatory monthly obligations. Additionally, contributions are imposed on various government entities by a decision from the Ministry of Finance.

The mechanism also redirects resources from the Teacher Fund, previously established by the Houthis, into this account. Furthermore, it allocates a percentage not exceeding 20% of monthly expenses and reinforcements designated for public service units, as well as up to 10% of the cost of investment programs for public sector units. Any surplus funds returned from the mechanism’s account itself are also included.

The resolution outlines the following provisions:

- Full salaries will be provided to key units, such as the parliament and judiciary, under Houthi control.

- Units lacking self-generated resources to cover employee salaries and wages will receive at least half their salaries each month.

- Employees in entities with self-generated resources, where operating expenses exceed their income, will receive half a salary every three months.

The law mandates that salaries be disbursed, based on lists approved by the Ministry of Civil Service and aligned with job discipline records. Once paid, the government is absolved of liability, and the amounts provided by government entities and units are not considered loans to the government. The law also nullifies any conflicting legislation.

This mechanism echoes the Houthi decision in 2017 to pay salaries via commodity cards — a policy that ultimately failed.

Consequences and Risks of the Mechanism

This mechanism, which is both improvised and unlawful, carries numerous risks and repercussions, including:

- Manipulation of Employees’ Rights: It primarily seeks to undermine the rights of public employees by replacing their entitlement to salaries with new lists prepared by the group, subject to its discretion and conditions. The mechanism also stipulates the government’s exemption from responsibility for any salaries outside these lists.

- Violation of Justice Principles: Despite claims of promoting fairness, the mechanism categorizes public employees into three groups and determines salary disbursements accordingly. This approach clearly violates justice principles, tying wages to the nature of the employee’s tasks rather than recognizing salaries as a right in exchange for public service work, irrespective of the sector.

- Seizure of Public Resources: The unrecognized Houthi authority uses this mechanism as a pretext to gain control over companies and government sector units, seizing their resources under the guise of paying employee salaries. It does so without recording the amounts as government debts, effectively appropriating the resources of public institutions and state-owned companies.

- Neglect of Teachers’ Rights: The mechanism pays little attention to teachers, who are among those who are most deprived of salaries and wages. This constitutes a new form of deception against educators, despite provisions to transfer the previously established Teacher Funds’ resources to the salary payment mechanism.

- Unrestricted Authority: The mechanism grants the Ministry of Finance unchecked power to determine contributions from government units and manage resources directly, bypassing legislative oversight.

- Exploitation of Taxation: The mechanism allows the group to impose a flat tax on luxury goods and non-locally produced items, along with an income tax on salaries exceeding 25,000 Yemeni riyals (approximately $47).

- Framework of Control Over Salary: The Houthis use the mechanism to enforce a new salary structure for public employees based on lists they compile, which include their loyalists replacing original employees who are displaced, dismissed or unable to work due to direly horrific living conditions.

- Dismissal of Historical Salary Lists: The mechanism effectively disregards demands to pay salaries, according to the Civil Service lists from 2014.

- Limitations on Depositors’ Rights: The group imposes a ceiling of 100,000 Yemeni riyals for depositors with investments in treasury bills, capped at 20 million riyals per deposit. According to leaked documents from the Central Bank branch in Sana’a, depositors would require approximately 16.5 years to recover their principal amount.

Conclusion

This mechanism contradicts constitutional and legal provisions, as well as the principles of justice and transparency in salary disbursement. It appears to have been introduced in response to the Houthi group’s concerns about the potential collapse of the Bashar al-Assad regime and the weakening of Iranian influence in Syria. Additionally, it seems aimed at preempting the growing public discontent, which could escalate into mass protests following the end of the war in Gaza.

The mechanism is designed to exploit the rights of government employees, creating disparities based on the importance of the institutions they serve to the Houthi agenda. It also serves as a tool for the group to tighten its control over companies and government sector units, enabling the appropriation of their resources. However, like previous attempts, this mechanism is likely to fail.